Traders are watching consumer confidence, sentiment and PCE inflation to understand whether Bitcoin and altcoins can continue last week’s surge.

Last week there was an important economic event, the Jackson Hole Rally boosts crypto Symposium, which pushed the crypto market higher. Now this week there are new economic events coming up in the U.S. that could give new signals to traders. Now the question is what should crypto investors focus on?

Table of Contents

Powell Speech Pushed Markets Up

Last Friday, the Jackson Hole symposium took place, the most important economic event in the U.S. Fed Chairman Jerome Powell hinted that a rate cut is possible. He said policy is still tight, but the labor market is weakening, posing a big risk.

He also said tariffs and slow immigration are putting pressure on supply and labor. Most importantly, the Fed could start cutting rates as soon as September if needed.

The crypto market reacted immediately. Bitcoin went back above $116,000, Ethereum jumped 22% to close to $4,900. Altcoins like XRP, Solana and Dogecoin also moved upward.

Key U.S. Economic Signals This Week

After last week’s rally, now crypto traders are closely watching important U.S. economic indicators which can affect the mood of Bitcoin and the overall market.

August Consumer Confidence

U.S. consumer confidence data will come on Tuesday. It shows how positive households feel about the economy and their spending power. Consumer confidence shapes the overall risk mood of the markets.

If the reading is lower than expected, it means people are cautious and spending is weak. This could push the Fed towards rate cuts, which would be good for Bitcoin and other risk assets as liquidity increases.

If the reading is higher than expected, it means consumers are strong and are spending more. In this case investors will prefer equities over crypto, which could put pressure on digital assets in the short-term.

According to economists, U.S. consumer confidence for August is expected to fall from 97.2 to 96.5.

MI Consumer Sentiment

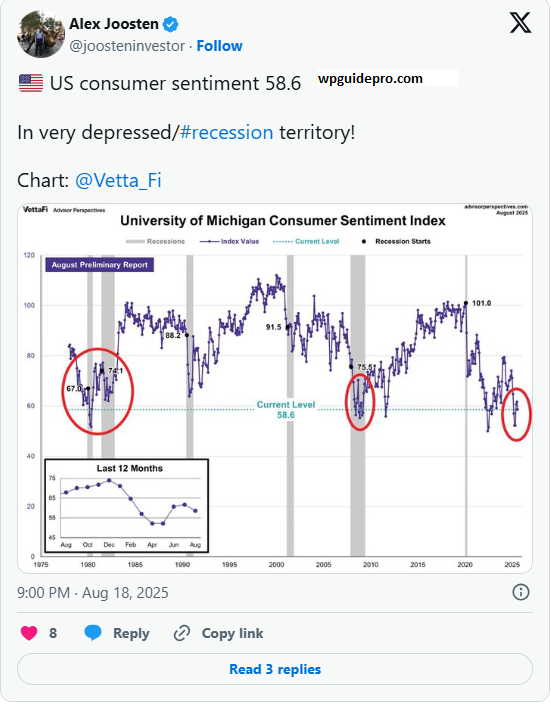

On Friday, the University of Michigan will release its Consumer Sentiment data. This is also an important indicator that shows the mood of households, much like consumer confidence. It shows how people feel about the economy, jobs and their finances.

If the reading is low, it means the economy is weak, as expectations of Fed easing are overcome and crypto gets a boost. If the reading is high, it means demand is strong, which supports traditional markets and funds can be withdrawn from crypto and go there.

Economists say that Consumer Sentiment will remain stable at 58.6. But analysts note that this level is still among the lowest readings in history, just like during the Great Financial Crisis and the 1980 recession.

July PCE Inflation Data

Another important U.S. economic indicator is PCE , which shows how much consumers are spending on goods and services. This data will also be released on Friday.

If the PCE reading is higher than expected, it means inflation is high. In this case, the chances of Fed rate cuts decrease, liquidity becomes tight and crypto prices could come under pressure in the short-term.

If the PCE reading is lower than expected, it means inflation pressure is decreasing. This increases the chances of Fed rate cuts and Bitcoin and altcoins could get a boost as risk appetite increases.

Economists are expecting headline PCE to remain stable at 2.6% year-over-year.

Why This Matters

If the Teeno indicators come as expected, it will be positive for crypto. This will keep the expectation of Fed policy easing alive and will support the risk appetite.

- Bitcoin 107K Breaks Strong as Bulls Eye Big Win

- Trump Crypto ETF Targets BTC And ETH in 2025

- Metaplanet Bitcoin Purchase Sparks Explosive 1111 BTC Buy

- Hyperliquid Builder Codes Top $10M New Crypto Boom Coming?

- Bitcoin Hits $123K Ahead of Make-or-Break

- Stellar (XLM) Explained: Easy Guide for Beginners

- JPMorgan Launching Crypto-Backed Loans With BTC and ETH

- SYRUP Defies Market Trends After Upbit Listing

- SHIB Hype Fades While Remittix Rises as the Smarter Crypto Choice

- CryptoPunks NFT Sells for $2.5M as NFT Market Shows Fresh Momentum

- XRP Price Expansion Phase: Can Ripple Reach $7 in 2025?

People Also Ask – Jackson hole rally boosts crypto:

What is Jackson Hole Symposium?

Jackson Hole rally boosts crypto Symposium is an annual economic meeting held in Wyoming. Central bank leaders, economists and policymakers meet to discuss global monetary policy and economic trends. The event also impacts financial markets and crypto.

How do U.S. economic indicators affect crypto?

U.S. data such as consumer confidence, consumer sentiment and PCE inflation shape investors’ mood and Fed policy expectations. If the data is weak, crypto gets support as people expect the Fed to ease. If the data is strong, more funds move into equities and crypto comes under pressure.

Why are Fed rate cuts important for crypto?

When the Fed cuts rates, liquidity increases and risk appetite becomes strong. This is why investors are more interested in buying crypto. If rates remain high, people invest less in risk assets like crypto.