Ethereum Network scalability issues have once again come under the spotlight after the network became so congested that transaction fees temporarily reached $1,000. This problem occurred in the Proof of Stake system when too many transactions began to occur on the network, causing gas fees to skyrocket.

Following Friday’s market crash, analysts are saying that if Ethereum stays above the $3.7K level, it will be fine; otherwise, the price could fall to $2.8K.

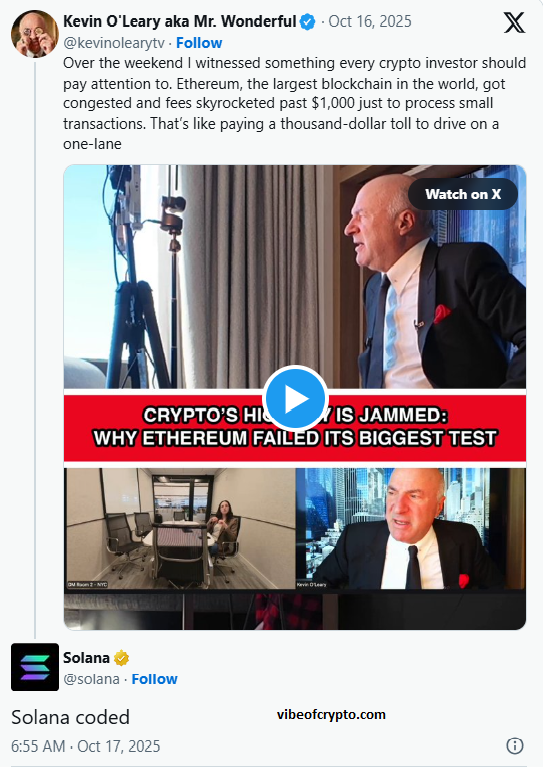

Canadian entrepreneur and crypto expert Kevin O’Leary also reacted to the situation. He tweeted on Thursday that charging fees of up to $1,000 for small transactions is completely wrong. According to him, Ethereum must urgently solve the scalability issue of its network, otherwise both users and developers will move away.

Table of Contents

Issue Ethereum Network $1,000 Fee Glitch?

Kevin O’Leary said, “It’s like paying a $1,000 toll to drive on a road.” He said that when people are using blockchain in real life, Ethereum being so slow and expensive doesn’t seem right. “When there’s too much load on the system, it breaks under the pressure,” he said.

This comment received mixed reactions from people on Twitter. Some agreed, and some said O’Leary was right. Some people suggested their own blockchains that were against Ethereum. Influencer Wendy O jokingly said, “So now we’re using Hedera?” While Solana users claim their network is the fastest.

Solana is indeed fast, but traffic congestion sometimes occurs on it as well. Ripple (XRP) and Hedera (HBAR) were also mentioned, which are separate from Ethereum, as both are in the testing phase of SWIFT.

XRP Ledger and HBAR Ethereum Network Picture

Currently, Ripple XRP Ledger is smaller than Ethereum in terms of market cap, but its daily trading volume reaches multi-billion dollars. Its fixed transaction fees and fast network have earned the trust of more than 300 banks worldwide.

On the other hand, the HBAR Network trading volume is not as high as XRP, but it is faster approximately 10,000 transactions per second, while XRP only processes 1,500.

Ethereum also has several Layer-2 solutions that are faster and more scalable than the main chain, but Kevin O’Leary says that Ethereum does not yet appear ready for full real-world use.

Why This Matters

When large financial systems like SWIFT handle over $155 trillion in transactions annually, it becomes crucial for blockchain to be globally ready.

- Bitcoin 107K Breaks Strong as Bulls Eye Big Win

- Trump Crypto ETF Targets BTC And ETH in 2025

- Metaplanet Bitcoin Purchase Sparks Explosive 1111 BTC Buy

- Hyperliquid Builder Codes Top $10M New Crypto Boom Coming?

- Bitcoin Hits $123K Ahead of Make-or-Break

- Stellar (XLM) Explained: Easy Guide for Beginners

- JPMorgan Launching Crypto-Backed Loans With BTC and ETH

- SYRUP Defies Market Trends After Upbit Listing

- SHIB Hype Fades While Remittix Rises as the Smarter Crypto Choice

- CryptoPunks NFT Sells for $2.5M as NFT Market Shows Fresh Momentum

- XRP Price Expansion Phase: Can Ripple Reach $7 in 2025?

- Cardano WLFI Stablecoin and Chainlink Partnerships

- Binance Futures Trading Paused: Market Prices Rattled

People Also Ask – Ethereum Network:

Why is Ethereum experiencing scalability issues now?

Over the weekend of October 12-13, 2025, Ethereum’s main network slowed down, with transaction fees reaching $1,000. This was due to excessive demand, as Kevin O’Leary explained. This suggests that Ethereum is currently experiencing scaling issues in time for real-world use.

How did O’Leary explain Ethereum’s issues?

He said that Ethereum is like a single-lane road with a toll booth. When too many transactions arrive, traffic jams occur, the system slows down, and costs skyrocket especially when the market suffers significant losses, such as the $19 billion liquidation.

How is Ethereum fixing its problems?

Ethereum is currently using Layer 2 solutions like rollups, which handle approximately 300 transactions per second. Upcoming updates like Fusaka are being designed to make the network faster. But Kevin O’Leary says it may not be ready for everyone to use yet.

How does this compare to blockchains like Solana?

Solana is faster and handles higher TPS, but even that sometimes experiences problems. Ethereum is slightly slower but is considered more stable and secure. O’Leary’s comments have sparked a new discussion between speed and stability.

What should we look for in Ethereum’s next step?

Keep an eye on the rollout of the Fusaka upgrade and the Layer 2 transition. Also, watch how Ethereum handles future market ups and downs. Also, keep following Kevin O’Leary’s X (Twitter) for his crypto-related updates.