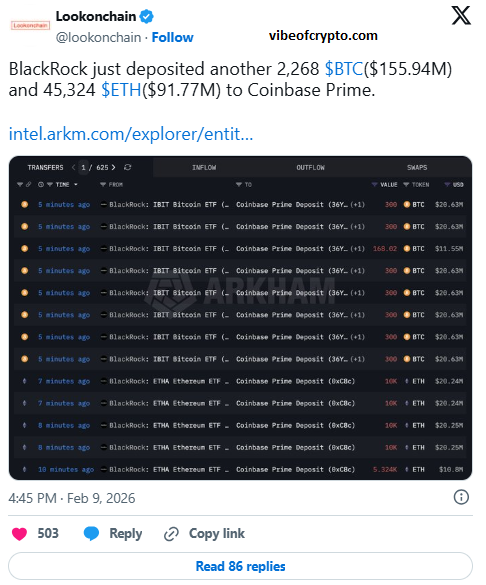

Large crypto transfers involving BlackRock Coinbase have once again created tension in the market.

According to blockchain data, large amounts of Bitcoin and Ethereum have been sent to Coinbase Prime. In one instance, approximately $170 million worth of BTC and ETH were transferred, and in another instance, assets worth approximately $291 million were moved.

When such a large amount of crypto is sent to an exchange, traders often assume a sale is possible. But not every transfer necessarily implies an immediate sale.

Sometimes, companies do this for liquidity, to reduce risk, or to handle investor withdrawals.

Table of Contents

Exchange Transfers Collide With a Fragile Tape

The timing of this move further increased market tension. These transfers occurred as crypto traders faced a major options expiry. According to industry estimates, approximately $2.5 billion worth of options were about to expire. During this time, Bitcoin’s price fell sharply and briefly approached $60,000.

Bitcoin later recovered slightly. Some traders say this rebound came after heavy liquidations, when people stopped taking on excessive risk. However, the market mood remains volatile due to repeated large transfers from institutions. Currently, spot ETF flows and daily buying and selling are having a greater impact on the price.

Further heating up the situation, BitMEX co-founder Arthur Hayes stated on social media that hedging activity around BlackRock’s spot Bitcoin ETF, IBIT, exacerbated the recent sell-off. This is difficult to confirm with public data, but it’s a debate raging in the market.

Some say the ETF system controls volatility. Others believe it sometimes accelerates price movements. Currently, the market appears cautious due to this uncertainty.

What Investors Should Watch For Next

The biggest question in the near term is whether the transfers on Coinbase will lead to real selling pressure in the market, or whether these are merely routine custody and internal movements.

Traders are now closely watching several things: whether there will be further transfers in on-chain data, what the daily inflows and outflows of ETFs are, and whether selling pressure on exchanges is increasing or remaining normal.

Options positions have now been reset, but the overall market sentiment can still change quickly. Therefore, there is not much tolerance for uncertainty.

This situation represents a new reality for crypto investors. Now, it’s not just news or market stories that move prices. ETF flows, hedging activity, and custody movements can also impact prices, and sometimes even more sharply.

- Bitcoin 107K Breaks Strong as Bulls Eye Big Win

- Trump Crypto ETF Targets BTC And ETH in 2025

- Metaplanet Bitcoin Purchase Sparks Explosive 1111 BTC Buy

- Hyperliquid Builder Codes Top $10M New Crypto Boom Coming?

- Bitcoin Hits $123K Ahead of Make-or-Break

- Stellar (XLM) Explained: Easy Guide for Beginners

- JPMorgan Launching Crypto-Backed Loans With BTC and ETH

- SYRUP Defies Market Trends After Upbit Listing

- SHIB Hype Fades While Remittix Rises as the Smarter Crypto Choice

- CryptoPunks NFT Sells for $2.5M as NFT Market Shows Fresh Momentum

- XRP Price Expansion Phase: Can Ripple Reach $7 in 2025?

- Cardano WLFI Stablecoin and Chainlink Partnerships

- Binance Futures Trading Paused: Market Prices Rattled

People Also Ask – BlackRock Coinbase:

What’s going on?

BlackRock-linked wallets recently transferred large amounts of Bitcoin and Ethereum to Coinbase Prime.

Is this a sale or a dump?

Not exactly. Transfers to Coinbase Prime are often for ETF operations such as redemptions, settlements, portfolio rebalancing, or liquidity management when investors withdraw their funds.

Why are traders so easily spooked?

Large on-chain movements on exchanges are often mistaken for whales selling. Therefore, the market becomes a little tense.