This week saw two big news items: a major company began working with BlackRock BUIDL Uniswap, and a court ruling was also positive. Both of these factors de-risked the market and boosted activity.

Uniswap UNI token fell by more than 20% in a single day. This occurred after BlackRock announced that it had purchased a small amount of UNI tokens. Additionally, BlackRock plans to bring shares of its tokenized Treasury Fund to Uniswap. The price briefly rose above $4.30, while Bitcoin and Ethereum prices were falling at the same time.

This plan relates to BlackRock’s USD Institutional Digital Liquidity Fund. Shares in this fund are held in the form of digital tokens, backed by safe assets such as US Treasury bills, cash, and short-term agreements.

The plan now is to make BUIDL shares tradable on UniswapX, a system that brings together various trading options. Tokenization company Securitize is also working with BlackRock on this project.

Table of Contents

TradFi Giant Buys Governance Tokens and Picks a Venue

BlackRock BUIDL purchase of governance tokens is somewhat unusual for traditional asset managers. With this move, UNI is no longer just a DeFi token, but is now being seen as a signal for institutional on-chain distribution.

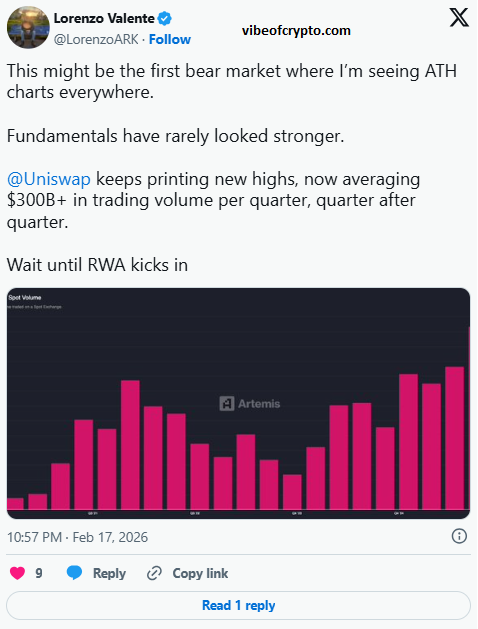

Uniswap is a popular decentralized exchange that operates on multiple blockchains. According to DeFi market data, it holds approximately $3 billion in deposits.

This announcement has also marked a significant shift. Many institutions are no longer just holding crypto coins through ETFs. They are now using decentralized platforms as a means of settlement and liquidity for tokenized securities. This is considered a new and more practical way of using crypto.

Legal Clarity Arrives As Traders Chase The Headlines

Momentum gained further support when a US federal judge dismissed a patent lawsuit against Uniswap Labs. Uniswap Labs is the company that develops the protocol’s interface and tools. The lawsuit was filed by entities associated with a rival automated market maker design. They claimed that Uniswap’s initial code was a copy of their patented system.

The court ruled that these patents were based on overly abstract ideas, such as currency exchange. Such ideas generally do not receive protection under US patent law.

This decision does not eliminate all legal risks for DeFi, but it certainly relieves a significant amount of pressure. Now developers can be less afraid of lawsuits while working on basic AMM systems, and innovation can get some courage.

- Bitcoin 107K Breaks Strong as Bulls Eye Big Win

- Trump Crypto ETF Targets BTC And ETH in 2025

- Metaplanet Bitcoin Purchase Sparks Explosive 1111 BTC Buy

- Hyperliquid Builder Codes Top $10M New Crypto Boom Coming?

- Bitcoin Hits $123K Ahead of Make-or-Break

- Stellar (XLM) Explained: Easy Guide for Beginners

- JPMorgan Launching Crypto-Backed Loans With BTC and ETH

- SYRUP Defies Market Trends After Upbit Listing

- SHIB Hype Fades While Remittix Rises as the Smarter Crypto Choice

- CryptoPunks NFT Sells for $2.5M as NFT Market Shows Fresh Momentum

- XRP Price Expansion Phase: Can Ripple Reach $7 in 2025?

- Cardano WLFI Stablecoin and Chainlink Partnerships

- Binance Futures Trading Paused: Market Prices Rattled

People Also Ask – BlackRock BUIDL:

Question: What did BlackRock announce on February 11, 2026?

Answer: BlackRock announced that it is partnering with Uniswap Labs and Securitize. Through this partnership, its tokenized U.S. Treasury fund, BUIDL, will now be tradable on UniswapX. This is BlackRock’s first direct foray into DeFi trading.

Question: What is BUIDL and how big is the fund?

Answer: BUIDL is a tokenized money market fund backed by safe assets like U.S. Treasuries and cash. It provides returns to institutional investors. The fund is estimated to be between $2.2 and $2.4 billion in size and is one of the largest tokenized real-world assets on the blockchain.

Question: How does the Uniswap integration work?

Answer: This system works through UniswapX. Only approved and verified institutional investors can use it. They can swap BUIDL with stablecoins like USDC 24/7 on-chain. Compliance and KYC are handled by Securitize.