Bitcoin longs pile price has a chance of reaching new highs, but traders using leverage should be careful. If the price doesn’t hold above $117,000, a long squeeze could occur.

Trading volume has increased by 24% since yesterday, and there is now approximately $84.10 billion in leverage in the futures market. If the price falls, all these positions could be closed out, resulting in significant losses.

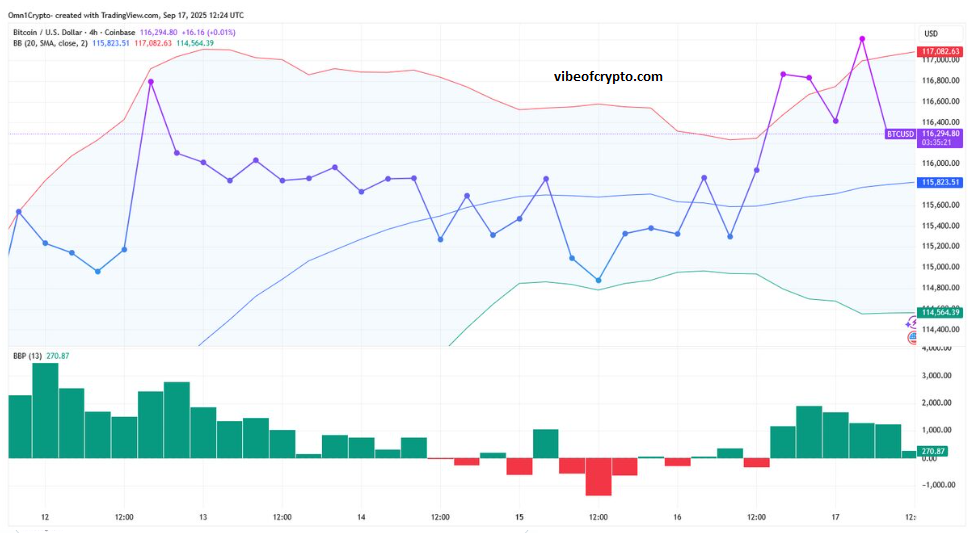

Currently, Bitcoin’s price is $116,360. If it moves above $117,091, the risk will be reduced. BTC is currently being supported by whales and bulls. Indicators are also looking mostly positive.

- Bitcoin 107K Breaks Strong as Bulls Eye Big Win

- Trump Crypto ETF Targets BTC And ETH in 2025

- Metaplanet Bitcoin Purchase Sparks Explosive 1111 BTC Buy

- Hyperliquid Builder Codes Top $10M New Crypto Boom Coming?

- Bitcoin Hits $123K Ahead of Make-or-Break

- Stellar (XLM) Explained: Easy Guide for Beginners

- JPMorgan Launching Crypto-Backed Loans With BTC and ETH

- SYRUP Defies Market Trends After Upbit Listing

- SHIB Hype Fades While Remittix Rises as the Smarter Crypto Choice

- CryptoPunks NFT Sells for $2.5M as NFT Market Shows Fresh Momentum

- XRP Price Expansion Phase: Can Ripple Reach $7 in 2025?

- Cardano WLFI Stablecoin and Chainlink Partnerships

- Binance Futures Trading Paused: Market Prices Rattled

People Also Ask – Bitcoin longs pile:

What is the current scenario for Bitcoin longs pile?

BTC is currently testing near $117,082. The middle Bollinger Band is at $115,823. Many traders are holding long positions here.

What is a long squeeze and why could it happen?

If BTC falls below $115,823, long holders will sell their positions in panic. Because leverage and funding rates are high, this could trigger quickly.

How did BTC get here?

BTC rose 5% in the last 24 hours and reached near $117,082. But this level is currently proving difficult to break, and this has eliminated the risk of a squeeze.

What will happen if the squeeze is triggered?

If BTC falls below $115,823, the price could fall sharply to $112,000 or even below. However, if it breaks above $117,082, it could even go above $120,000.

What should I do today?

Be careful. Closely monitor the $115,823–$117,082 range. Check real-time charts and seek expert advice as the market is currently very sensitive.