Metaplanet is buying bitcoin again, and Saylor has indicated that corporate interest is growing again while the market is uncertain.

The interest of companies in Bitcoin came to the fore again when MicroStrategy co-founder Michael Saylor again revived the enthusiasm for Bitcoin sovereignty.

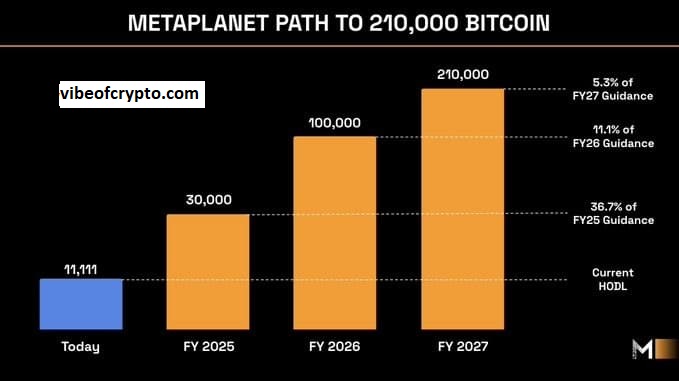

Saylor posted on X: How many companies have the path to becoming Bitcoin sovereign? This post came at the time when Tokyo company Metaplanet announced to buy 1111 Bitcoins, after which it had a total of 11111 BTC

Table of Contents

New Buy Timing and Metaplanet Market Expectations

This time was not a test at all. Analysts are watching with enthusiasm that MicroStrategy often announces new Bitcoin purchases at the beginning of the week after the weekend’s crypto posts

No new filings were made on Monday, but Saylor’s secret message and the earlier chart posts generated rumors that perhaps buying is near again. He wrote these words on Sunday night that nothing stops this orange which further intensified this conversation

World Tensions Are Shaking Financial Markets

This step was raised in the volatile conditions of the crypto market. The value of Bitcoin fell to below one hundred thousand dollars because of political tension and military pressure. When over the weekend America carried out a military attack on Iran’s nuclear facilities and fear spread.

Then Iran’s parliament threatened to shut down the Hormuz train which is an important part of the tail’s path. The fear of oil shortage took away the fear of inflation and investors moved away from things like Bitcoin. The price of Bitcoin fell to ninety eight thousand dollars and then bounced back when long positions of nearly two billion dollars were closed.

Bitcoin has remained in the same range for the last five weeks and could not go above ten thousand dollars. The world’s famous crypto fell by more than five percent last week but Bitcoin’s market share is back to close to forty four point nine percent. This information is obtained from CoinMarketCap.

Oil and Gold Trends Shaping Today’s Market Outlook

Despite the US air strikes over the weekend, when the attack on Iran’s nuclear facility created a fear of a tailspin and the stock market saw a fall, the market remained lonely until Monday. Now analysts are expecting stability to return soon.

Initially, oil futures had gone to more than eighty dollars per barrel, but later the prices came back down when investors re-evaluated the situation. Gold prices also fell as the market outlook was changing.

Kobeissi posted a new letter on X that oil prices are still well below the levels that would have led to a long-term Middle East conflict. He wrote that this market is not pricing in a long battle but is still waiting for a short war.

Why This Matters

When Bitcoin is maintaining its value in the same range amid the massive price fluctuations and companies show their confidence, then players like Metaplanet suggest that the story of “Bitcoin Sovereign” may have a new ending.

See more news about Crypto on DailyCoin: