Standard Chartered has updated its XRP price prediction, but market sentiment appears to be moving in another direction.

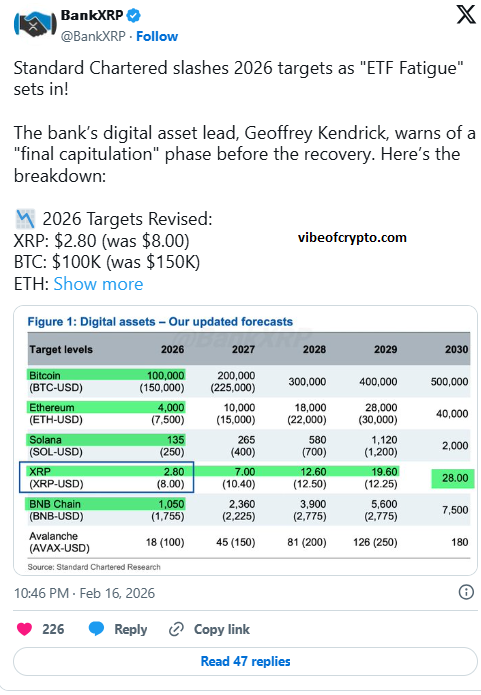

The bank has reduced its 2026 target for XRP to $2.80. Previously, its target was higher, so this represents a significant reduction of approximately 65%. This update comes at a time when XRP is trying to stabilize around $1.40 after a recent surge in February.

This news has had an impact on market sentiment. Although XRP shows slight recoveries daily, such predictions from major institutions make people cautious.

This often happens in the crypto market. The opinions of major banks and experts change quickly, but the true direction is often determined by where the money is flowing in the market. Sometimes the predictions are one thing, and the market’s behavior is another.

Table of Contents

A Lower Ceiling From a Major Bank

Standard Chartered’s new $2.80 target resets expectations for investors who were previously anticipating a higher long-term XRP price. At the time of the update, XRP was trading at around $1.48. The price increased only slightly that day, suggesting that traders handled the news without panic and there was no significant selling.

The bank did not clearly explain why it lowered the target. It could be due to changes in the speed of adoption, market structure, or overall risk appetite. But the most important thing is that the target was cut significantly.

This update comes at a time when major altcoins are already struggling and unable to reclaim important technical levels. Therefore, market confidence still appears to be low.

Capital Flows Point The Other Way

Interestingly, XRP has taken the top spot in institutional investment during this period. According to a new report, XRP price has seen the highest net inflows among major digital assets, while Bitcoin and Ethereum lagged behind.

This is also significant because money is flowing out of digital asset investment products overall. Reports indicate that approximately $173 million has been outflowed in just one week, and total redemptions this month have reached billions.

This could mean that investors are not completely exiting the crypto market. Rather, they are shifting their money from one asset to another. This process is called rotation, and some investors are currently moving money into XRP.

It’s not yet clear whether this is buying on a dip, due to better value, or because people believe there may be positive news or a catalyst for XRP. But it’s certain that money isn’t just flowing out of the market, it’s actually changing direction.

- Bitcoin 107K Breaks Strong as Bulls Eye Big Win

- Trump Crypto ETF Targets BTC And ETH in 2025

- Metaplanet Bitcoin Purchase Sparks Explosive 1111 BTC Buy

- Hyperliquid Builder Codes Top $10M New Crypto Boom Coming?

- Bitcoin Hits $123K Ahead of Make-or-Break

- Stellar (XLM) Explained: Easy Guide for Beginners

- JPMorgan Launching Crypto-Backed Loans With BTC and ETH

- SYRUP Defies Market Trends After Upbit Listing

- SHIB Hype Fades While Remittix Rises as the Smarter Crypto Choice

- CryptoPunks NFT Sells for $2.5M as NFT Market Shows Fresh Momentum

- XRP Price Expansion Phase: Can Ripple Reach $7 in 2025?

- Cardano WLFI Stablecoin and Chainlink Partnerships

- Binance Futures Trading Paused: Market Prices Rattled

Why This Matters For Traders Now

For crypto investors, the key point of this news isn’t just the $2.80 number, but rather the mixed signals from the market. On one hand, analysts are becoming more cautious, but on the other, money is still flowing into the market.

In simple terms, experts are somewhat skeptical, but investors aren’t completely abandoning the market.

The practical effect of this situation is that the price doesn’t move straight up or down. The market fluctuates most of the time.

• When negative news arrives, the price’s rapid upward move is halted.

• However, because buying is also occurring, the price doesn’t fall too far.

That is, rallies remain weak, but there isn’t a major crash.

This situation can continue until some important news arrives such as a change in the macroeconomy, an interest rate decision, or regulatory clarity. Only such strong news can give the market clear direction.