The best matches for SWIFT have been found. OMFIF Ripple XRP for Fast and Low Cost Cross Border Payments research indicates that XLM and XRP are the best choices.

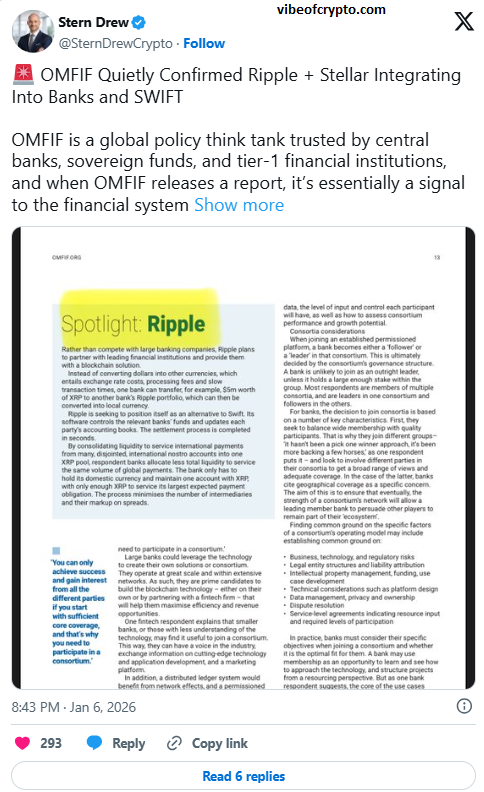

OMFIF is a renowned financial research organization trusted by many of the world’s largest banks. They have released a report outlining how the global financial system could change in the future.

According to this report, the new financial system will require a fast, cheap, and secure payment system. Therefore, XLM and XRP are considered strong options.

Table of Contents

SWIFT Approach: ISO Nominees Take The Lead

According to the latest report, Ripple is not a direct adversary of SWIFT. Instead, blockchain technology is being integrated with SWIFT’s new ISO 20022 messaging system. Similarly, technologies like Stellar and IOTA could also be used to make payments faster and improve liquidity.

SWIFT plans to make international payments real-time. XRP Ledger could help with this, as it handles billions of dollars in transactions daily.

OMFIF report says that XRP could be a strong alternative to SWIFT. The most important thing is that to use it, there will be no need to change the entire financial system, which people generally believe.

SWIFT vs. XRP: Collaboration Over Competition

In this way, SWIFT will maintain its messaging system, while XRP and Stellar will handle value transfer, speed, and liquidity.

OMFIF Ripple XRP advises the world’s major banks, financial institutions, and governments. If XRP and XLM are recommended in the report, it could accelerate their adoption in the future.

According to crypto analyst Stern Drew, the adoption process typically goes like this:

First, testing occurs on the blockchain, as SWIFT did with XRP, HBAR, and XLM.

Then, based on the results, each project is assigned a different role based on its best use case.

After that, integration into the system occurs quietly. Finally, one day the system is activated and crypto payments begin.

SWIFT completed testing of DLT-based tokens in the last quarter of 2025. They did not share the results, but stated that they are working with multiple blockchains simultaneously to enable faster payments and better connections.

OMFIF research also makes it clear that this technology is not meant to replace the old financial system, but rather to work in conjunction with it. SWIFT and banks can use technologies like XRP and HBAR to improve the system without direct competition.

- Bitcoin 107K Breaks Strong as Bulls Eye Big Win

- Trump Crypto ETF Targets BTC And ETH in 2025

- Metaplanet Bitcoin Purchase Sparks Explosive 1111 BTC Buy

- Hyperliquid Builder Codes Top $10M New Crypto Boom Coming?

- Bitcoin Hits $123K Ahead of Make-or-Break

- Stellar (XLM) Explained: Easy Guide for Beginners

- JPMorgan Launching Crypto-Backed Loans With BTC and ETH

- SYRUP Defies Market Trends After Upbit Listing

- SHIB Hype Fades While Remittix Rises as the Smarter Crypto Choice

- CryptoPunks NFT Sells for $2.5M as NFT Market Shows Fresh Momentum

- XRP Price Expansion Phase: Can Ripple Reach $7 in 2025?

- Cardano WLFI Stablecoin and Chainlink Partnerships

- Binance Futures Trading Paused: Market Prices Rattled

People Also Ask – OMFIF Ripple XRP:

What did OMFIF say about Ripple?

According to OMFIF, Ripple payment system and XRP Ledger are a fast and inexpensive way to send money internationally. They also have strong security features, such as KYC approval, account freezing, and a system for withdrawing funds upon need.

How is XRP different from SWIFT?

XRP allows for direct person-to-person or bank-to-bank payments. It eliminates the need for multiple banks. This results in faster money transfers and lower costs. It also requires less pre-funding and benefits from the speed of the blockchain.

Is this news positive for XRP?

Yes, this is good news for XRP. Support from a major organization like OMFIF could boost banks’ trust. This could lead to greater use of XRP for international payments and real-world assets in the future.