Friday’s market crash caught major crypto players by surprise. Many people’s risky and high-leverage plans failed.

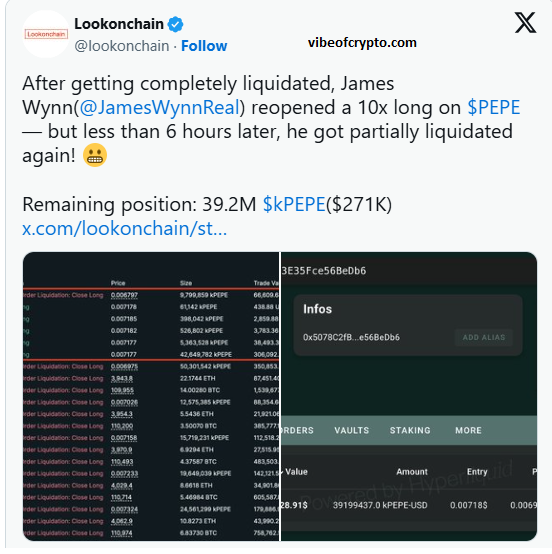

According to blockchain analytics company LookOnChain, a famous crypto whales whale placed a big gamble on Pepe Token the world’s third-largest meme coin but his plan backfired.

Table of Contents

PEPE Price Crypto Whales, Slimming Wynn’s Wallet

This risky trade was placed by none other than James Wynn a renowned crypto trader who became famous at the inception of Pepe Token. But high leverage trading doesn’t always pay off, as the losses of two major crypto whales this week proved.

On Thursday, James Wynn suffered multi-million dollar losses in PEPE, Ethereum, and Bitcoin. But without thinking, he placed a new trade with 10x leverage on PEPE and when the price of PEPE fell further, some of his money was again liquidated.

Tariff-Fueled Market Turbulence Crypto Whales

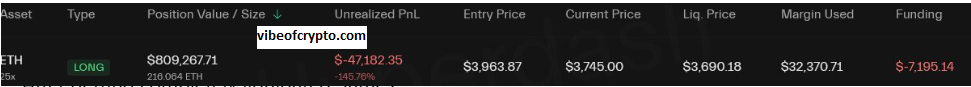

In another case, Machi Big Brother, a member of the Bored Ape Yacht Club and a renowned digital art trader, suffered a massive loss of $53 million. Against James Wynn, Machi had placed a bet solely on Ethereum when the price dropped from $4,195 to $3,939.

The price of Ethereum is currently $3,745, representing another loss. Machi has again entered a long trade on ETH with 25x leverage, where he has already lost $47,182 at an entry price of $3,963.

According to data from Hyperliquid, his next liquidation point is around $3,690. This means that it has pulled back to $266,086 in just 24 hours, leaving it with just over $29,000.

The situation is also dire for Pepe Token this Ethereum-based frog meme coin has broken its strong support level below $0.000007 and is down 75% from its all-time high.

- Bitcoin 107K Breaks Strong as Bulls Eye Big Win

- Trump Crypto ETF Targets BTC And ETH in 2025

- Metaplanet Bitcoin Purchase Sparks Explosive 1111 BTC Buy

- Hyperliquid Builder Codes Top $10M New Crypto Boom Coming?

- Bitcoin Hits $123K Ahead of Make-or-Break

- Stellar (XLM) Explained: Easy Guide for Beginners

- JPMorgan Launching Crypto-Backed Loans With BTC and ETH

- SYRUP Defies Market Trends After Upbit Listing

- SHIB Hype Fades While Remittix Rises as the Smarter Crypto Choice

- CryptoPunks NFT Sells for $2.5M as NFT Market Shows Fresh Momentum

- XRP Price Expansion Phase: Can Ripple Reach $7 in 2025?

- Cardano WLFI Stablecoin and Chainlink Partnerships

- Binance Futures Trading Paused: Market Prices Rattled

People Also Ask – Crypto Whales:

What happened to whales trading PEPE and ETH?

Big traders, like James Wynn, lost millions in Friday’s market crash. Their leveraged long trades in PEPE and ETH were liquidated on the Hyperliquid exchange, as tracked by Lookonchain.

Why did they trade again after losing everything?

After the liquidation, some whales, including Wynn, resumed trading to recover their losses. But the market fell again, and they lost even more this overconfidence proved risky for them.

How much did James Wynn lose?

Wynn’s account suffered a massive $23.28 million loss when his leveraged long trades 50.3 million PEPE and 12.17 ETH were closed at a complete loss.

Why did the market go so crazy?

On October 16, 2025, Bitcoin plummeted below $103,000, leading to $1.9 billion in liquidations. Hyperliquid’s auto-deleveraging system and high volatility exacerbated the situation.

What should we learn from all this?

Never over-leverage and chase losses, especially on volatile coins like PEPE and ETH. Trade with an understanding of market trends and liquidation risk updates from sites like vibeofcrypto can help you avoid these crashes.