Bitcoin Ethereum prices are expected to change as a large number of options are set to expire on Friday with a total value of over $5.3 billion.

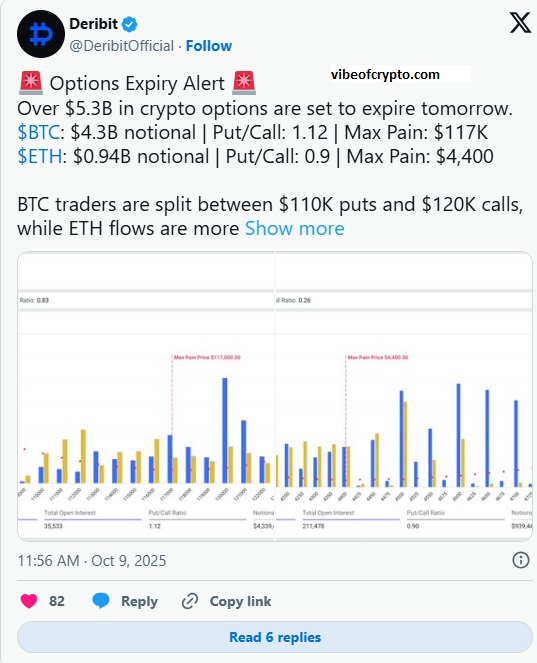

According to data from Deribit, $4.3 billion worth of Bitcoin options are set to expire. Its Put/Call ratio is 1.12, indicating a slightly bearish sentiment, and the maximum pain level is set at $117,000.

Approximately $940 million worth of Ethereum options will also expire. Its Put/Call ratio is 0.9, indicating a slightly bullish sentiment, and the maximum pain price is set at $4,430.

Options give traders the right to buy or sell an asset at a fixed price before an expiration date—usually on a weekly or monthly basis.

The Put/Call ratio reflects market sentiment higher, bearish, and lower, bullish. Max pain is the level where most traders incur losses, and the price remains around that level at expiry.

Bitcoin fell 0.35% in the past 24 hours and is now trading at around $121,700, while Ethereum is down 2% and is now around $4,300.

Table of Contents

Possible Effects – Bitcoin Ethereum

Market experts are saying that the $5.3 billion options expiry on Friday could lead to short-term fluctuations in crypto prices as traders close or renew their positions.

Bitcoin appears slightly bearish, meaning some traders are hedging against losses at the $117,000 level. But ETF inflows and significant investor interest could keep the market from falling further.

BlackRock’s Bitcoin ETF saw new inflows of $426.2 million on Wednesday, bringing its total holdings to 802,197.8 BTC worth $98 billion, or about 3.8% of Bitcoin’s total supply.

Ethereum setup appears more stable as traders are preferring calls, which could help keep the price stable around $4,400.

Why This Matters – Bitcoin Ethereum

The overall market may remain somewhat volatile. Prices may fluctuate and form tight ranges, but a strong breakout is not expected until the impact of expiry becomes fully clear.

- Bitcoin 107K Breaks Strong as Bulls Eye Big Win

- Trump Crypto ETF Targets BTC And ETH in 2025

- Metaplanet Bitcoin Purchase Sparks Explosive 1111 BTC Buy

- Hyperliquid Builder Codes Top $10M New Crypto Boom Coming?

- Bitcoin Hits $123K Ahead of Make-or-Break

- Stellar (XLM) Explained: Easy Guide for Beginners

- JPMorgan Launching Crypto-Backed Loans With BTC and ETH

- SYRUP Defies Market Trends After Upbit Listing

- SHIB Hype Fades While Remittix Rises as the Smarter Crypto Choice

- CryptoPunks NFT Sells for $2.5M as NFT Market Shows Fresh Momentum

- XRP Price Expansion Phase: Can Ripple Reach $7 in 2025?

- Cardano WLFI Stablecoin and Chainlink Partnerships

- Binance Futures Trading Paused: Market Prices Rattled

People Also Asked – Bitcoin Ethereum

What are crypto options?

Crypto options are trading contracts that give you the right—but not the obligation—to buy or sell a cryptocurrency at a set price before a specific date. Traders often use them to protect their investments or to make strategic bets on market movements.

How do crypto options work?

Every option has two main parts a strike price and an expiry date. If you expect the price of Bitcoin or Ethereum to rise, you can buy a call option. If you think it will drop, you can buy a put option. The value of your option changes as the crypto’s market price moves.

Why do crypto options affect market volatility?

When a large batch of options contracts expires, traders quickly rebalance their positions either by buying or selling crypto. This sudden activity often causes short-term price swings, leading to temporary spikes in volatility.