The crypto market liquidations a severe decline on Monday. $151 billion was wiped out of the market in just 24 hours. This is the fastest sell-off of this bull cycle. The total crypto market is now worth $3.88 trillion, according to SoSoValue.

Table of Contents

A $1.7B crypto market liquidations

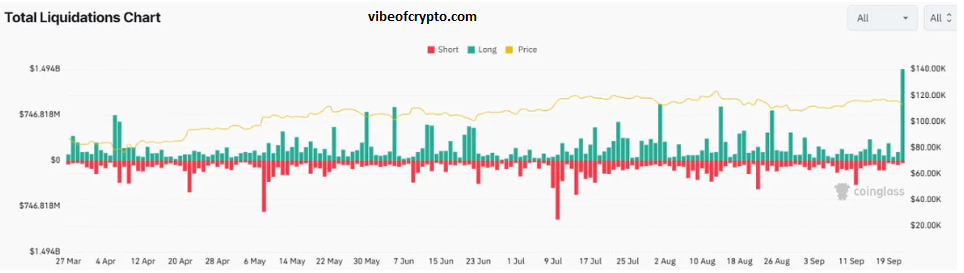

According to CoinGlass data, approximately $1.7 billion in leveraged bets were wiped out, representing 406,000 traders.

Long positions accounted for the lion’s share of losses. Ethereum alone accounted for $500 million in losses, and Bitcoin liquidations reached $280 million.

Because many leveraged positions were at the same price level, even small declines triggered stop-losses. This resulted in a small pullback becoming a significant decline.

Bitcoin, Ethereum Lead the Slide Crypto Market Liquidations

Not a single token was spared. Bitcoin fell 2.5% to below $113,000. Ethereum dropped nearly 7% to $4,100. XRP and Solana both fell more than 7%, while Dogecoin and Hyperliquid (HYPE) lost their post-Fed meeting gains, falling more than 10%.

Fear Greed Index also declined, moving from neutral to bearish territory. The Altcoin Season Index fell to 64, indicating that people are no longer as interested in taking risks as before.

Traders See Opportunity, Not Collapse – Crypto Market Liquidations

Despite the market turmoil, traders attributed the drop to a normal leveraged flush, not a market top.

Trader Tanaka wrote: “The market now appears healthier, and better entry zones have emerged. Such dips are part of the game and form the foundation for the next upward move.”

Institutions Keep Buying – Crypto Market Liquidations

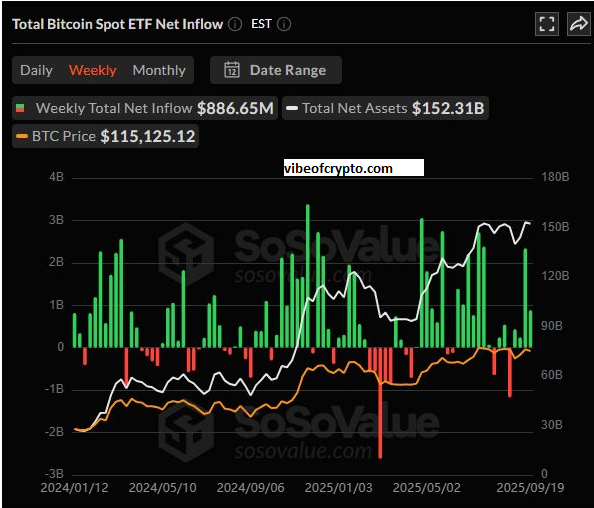

Despite market turmoil, institutional demand remains strong. According to SoSoValue, Bitcoin spot ETFs saw net inflows of $886.65 million last week. This was more than double the previous week’s $2.34 billion.

Ethereum spot ETFs followed a similar trend, recording inflows of nearly $500 million for the second week running.

This steady buying suggests that large investors are buying on dips, proof that real demand for crypto remains strong.

Why It Matters – Crypto Market Liquidations

Such shakeouts are a normal part of bull markets. Over-leveraged traders exit the market, selling pressure subsides, and liquidity moves back to strong investors.

- Bitcoin 107K Breaks Strong as Bulls Eye Big Win

- Trump Crypto ETF Targets BTC And ETH in 2025

- Metaplanet Bitcoin Purchase Sparks Explosive 1111 BTC Buy

- Hyperliquid Builder Codes Top $10M New Crypto Boom Coming?

- Bitcoin Hits $123K Ahead of Make-or-Break

- Stellar (XLM) Explained: Easy Guide for Beginners

- JPMorgan Launching Crypto-Backed Loans With BTC and ETH

- SYRUP Defies Market Trends After Upbit Listing

- SHIB Hype Fades While Remittix Rises as the Smarter Crypto Choice

- CryptoPunks NFT Sells for $2.5M as NFT Market Shows Fresh Momentum

- XRP Price Expansion Phase: Can Ripple Reach $7 in 2025?

- Cardano WLFI Stablecoin and Chainlink Partnerships

- Binance Futures Trading Paused: Market Prices Rattled

People Also Ask – Crypto Market Liquidations:

What triggered the latest crypto market sell-off?

The market plummeted in September due to a high number of leveraged liquidations. Nearly $1.7 billion in long positions were wiped out, causing Bitcoin, Ethereum, and other altcoins to plummet.

What role do leveraged positions play in a market sell-off?

When traders borrow heavily and go long, even a small price drop triggers stop-losses and margin calls. This leads to forced selling and a sharp decline, and a small pullback turns into a major sell-off.

Are institutional investors worried about the market sell-off?

Despite market volatility, large investors are still buying. Bitcoin and Ethereum spot ETFs are experiencing inflows, suggesting they are buying the dip, rather than exiting the market.

Could this be the start of a bigger crash?

Most experts say this is a healthy shakeout. By removing over-leveraged traders, the market resets and becomes more stable for the next Bitcoin and Ethereum rally.