Grayscale Avax ETF Investments wants its Avalanche trust to become an ETF that trades on the NASDAQ. This ETF will simply follow the price of AVAX.

The money invested in this ETF will be redeemed in cash, and this process will be done through authorized participants. Coinbase Prime has been chosen to handle AVAX spot trading and custody.

Grayscale has already launched Bitcoin and Ethereum ETFs, and both were successful. If the AVAX ETF is approved, investors will get exposure to AVAX without buying crypto directly.

Table of Contents

Grayscale AVAX ETF Hits 1.7M Daily Transactions: What’s Driving It?

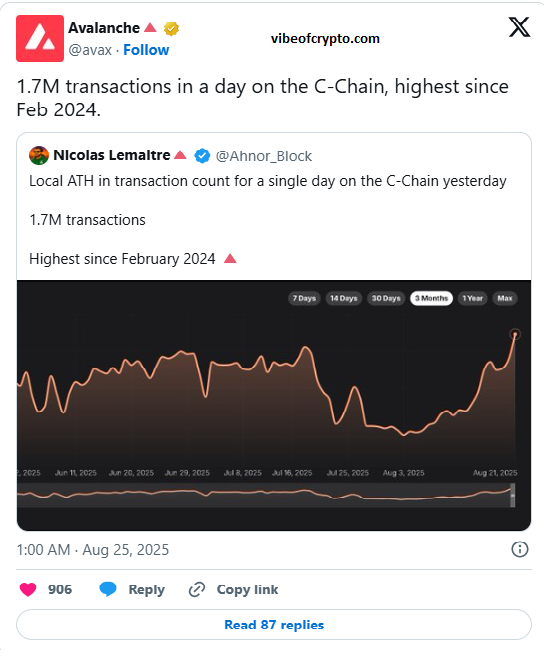

Avalanche is currently trading at $24.04, and its 24-hour trading volume has reached almost $1 billion. This volume is very high and is even higher than many larger coins like Aave , Arbitrum (ARB) and Uniswap (UNI). Yesterday, 1.7 million transactions took place on Avalanche’s C-Chain, which is the largest number this year.

According to DappRadar, Uniswap V3 gained the most trading volume, which was $65 million. After that, ODOS DeFi and Trader Joe dApp together traded $40.76 million. This activity was the highest since February 2024.

But despite so much activity, the price of AVAX fell 7.4% from yesterday’s close. There were huge liquidations on Sunday in which almost $250 billion was wiped out in minutes. Even now AVAX is far away from its all-time high of $144 (which was hit 4 years ago). If trading on C-Chain continues like this, then AVAX still has a lot of potential.

- Bitcoin 107K Breaks Strong as Bulls Eye Big Win

- Trump Crypto ETF Targets BTC And ETH in 2025

- Metaplanet Bitcoin Purchase Sparks Explosive 1111 BTC Buy

- Hyperliquid Builder Codes Top $10M New Crypto Boom Coming?

- Bitcoin Hits $123K Ahead of Make-or-Break

- Stellar (XLM) Explained: Easy Guide for Beginners

- JPMorgan Launching Crypto-Backed Loans With BTC and ETH

- SYRUP Defies Market Trends After Upbit Listing

- SHIB Hype Fades While Remittix Rises as the Smarter Crypto Choice

- CryptoPunks NFT Sells for $2.5M as NFT Market Shows Fresh Momentum

- XRP Price Expansion Phase: Can Ripple Reach $7 in 2025?

People Also Ask:

Grayscale AVAX ETF is a surprise?

Grayscale has submitted a file with the SEC in which it wants to make its Avalanche AVAX trust an ETF that will trade on Nasdaq. Its ticker will be AVAX. Coinbase Custody and BNY Mellon will support the backend of this fund. If approved, normal investors will also be able to easily invest in AVAX.

How can this filing affect the altcoin market?

If the SEC approves the ETF, people will be able to buy AVAX through brokers. This can increase demand and liquidity. Grayscale has also filed for ETFs of XRP and Dogecoin, which can create a new trend for altcoins and challenge the monopoly of Bitcoin.

How will this ETF be made?

Grayscale already has a $1.76M AVAX trust which was launched in August 2024. Nasdaq also filed one in March 2025. But to create an ETF, SEC will have to give two approvals. This process can be stretched till October 2025 and approval is not guaranteed.

Will the price of AVAX go up or down?

AVAX is currently trading between $24-$25 and has fallen 4% to $24.10 after the filing. If the ETF is approved, the price could push to $30. If there is a delay or rejection, the price could remain in the $22-$26 range or fall to $21.

What should traders monitor?

It is important to watch AVAX’s $24 support and $26-$27 resistance. Also follow Big Whale Activity X (Twitter). Also track SEC’s 240-day review and VanEck’s AVAX ETF filing. If it is approved then the rally will take place, if there is a delay then the momentum could slow down.